The biggest news in the cryptoverse for Nov. 17 includes the high selling tendency of Bitcoin holders older than 10 years, SBF’s $1.6 billion personal loan from Alameda Research, and Bitcoin and Ethereum’s emergence as the second and third most shorted crypto asset.

CryptoSlate Top סטאָריעס

ווער סאָלד די מערסט בטק אין די אַפטערמאַט פון די FTX ייַנבראָך? 10 יאָר האָלדערס פאַרקויפן אין די העכסטן טאָמיד קורס

די ייַנבראָך פון FTX put immense pressure on investors, while the price of Bitcoin (בטק) fell as low as $15,000.

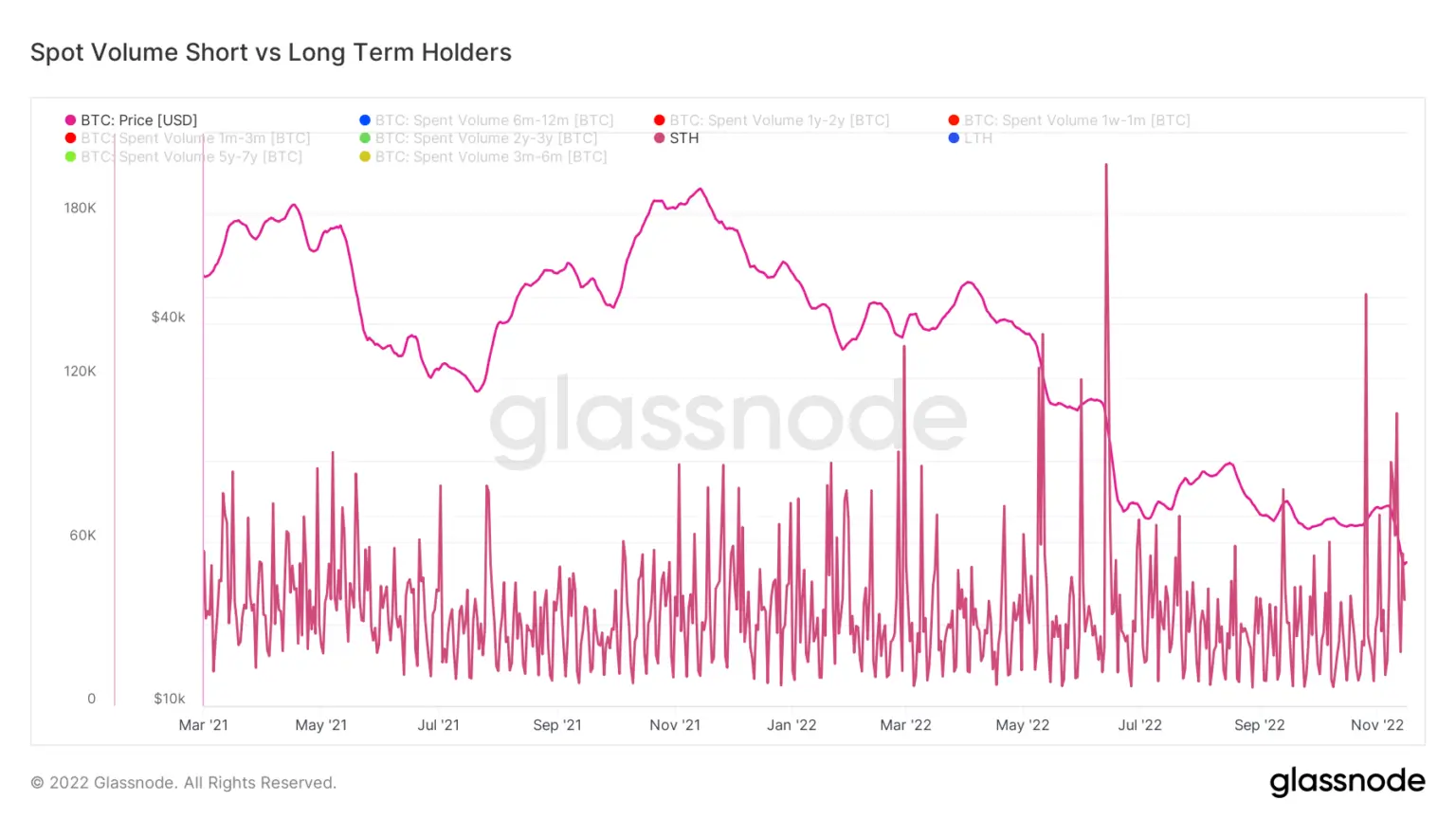

To reveal where the selling pressure was coming from, CryptoSlate analysts examined the short-term (STH) and long-term holders (LTH).

While history shows that the LTH is the first to sell their coins when the numbers start to fall, the turmoil following the FTX collapse didn’t shake the confidence of long-term holders.

Instead, the market recorded its fifth-largest number of STH sellers since March 2021, which translates to around 400,000 Bitcoins sold by STH between Nov. 10 and Nov. 17.

פטקס באַנקראָט פּלאַץ ריווילז אַז אַלאַמעדאַ האָט געגעבן $ 1.6 ב לאָונז צו SBF, אנדערע

FTX’s new CEO John Ray III’s court filing revealed that Sam Bankman Fried (SBF) got $1 billion in personal loans from Alameda פאָרשונג.

Ray referred to the situation as a “complete failure of corporate controls and such a complete absence of trustworthy financial information.”

The filing also disclosed that Alameda lent $543 million to FTX director of engineering Nishad Singh and $55 million to FTX Co-CEO Ryan Salame.

FTX ייַנבראָך זעט ביטקאָין, עטהערעום צו זיין שאָרטיד די רגע און דריט-מערסט סומע

After the FTX collapse, Ethereum (עטה) became the second-most shorted crypto in the market, followed by Bitcoin as the third.

According to the average funding rate set by exchanges for perpetual futures contracts, long positions pay periodically, while shorts pay whenever the rate percentage turns positive. The recent profound negative fund rates indicate an upcoming depression before the markets start healing.

גענעסיס געזוכט $ 1 ב נויטפאַל אַנטלייַען אָבער קיינמאָל גאַט עס

Crypto lender genesis sought out an emergency loan of $1 billion from investors but never got it, as the Wall Street Journal reported.

The reports noted that Genesis sought the funds because of a “liquidity crunch due to certain illiquid assets on its balance sheets.”

פטקס אַטאַקער האלט סוואַפּינג טאָקענס; יקסטשיינדזשיז $ 7.95M BNB פֿאַר BUSD, ETH

The FTX attacker kept their hands busy on Nov. 17 and drained around $600 million in one day. In three transactions, they swapped 30,000 BNB tokens for Ethereum and Binance USD (BUSD).

The exploiter currently holds $11.8 million BNB and ETH, worth around $346.8 million at the current price levels.

פרעזידענט בוקעלע ריווילז אַז על סאַלוואַדאָר וועט קויפן 1 ביטקאָין טעגלעך

El Salvador’s president Nayib Bukele announced that the country would start buying one Bitcoin daily, beginning on Nov. 18.

מיר קויפן איינער # ביטקאָין יעדער טאָג סטאַרטינג מאָרגן.

- Nayib Bukele (@nayibbukele) נאוועמבער קסנומקס, קסנומקס

El Salvador has been heavily criticized for its Bitcoin investments. However, the country didn’t cave and continued to express its confidence in crypto. El Salvador spent over $100 million to acquire the 2,381 Bitcoins it currently holds.

Mainstream media called out for gaslighting over Sam Bankman-Fried’ good guy’ narrative

The crypto community reacted to the mainstream media outlets for publishing articles that favor SBF, even after the FTX’s collapse.

The community reminded the imprisonment of the Tornado Cash developer Alexey Pertsev and expressed its frustration about SBF being free.

קרייַז טראפנס ייעלדס צו 0%

וסד מאַטבייע (וסד) issuer קרייַז dropped its yield product APY rate to 0% and said that its yield product is overcollateralized and secured by “robust collateral agreements.”

An announcement on Circle’s official Twitter also detailed its overcollateralized fixed-term yield product.

1/ Circle Yield איז אַן אָוווערקאַלאַטעראַליזעד פאַרפעסטיקט-טערמין טראָגן פּראָדוקט. גענעסיס איז אַ קאַונטערפּאַרטי צו סירקלע אין דעם פּראָדוקט. גאַנץ סירקלע ייעלדס קונה לאָונז זענען 2.6 מיליאָן דאָללאַרס זינט 11/16/22 און זענען פּראָטעקטעד דורך געזונט קאַלאַטעראַל אַגרימאַנץ.

— קרייז (@סירקלע) נאוועמבער קסנומקס, קסנומקס

סינגאַפּאָר ס טעמעסעק שרייבט אַוועק $ 275M FTX ינוועסמאַנט, האט מיספּלייסט גלויבן אין Sam Bankman-Fried

Singapore-based investment fund Temasek stated that it is writing off its $275 million investment in FTX, saying it had misplaced its “belief in the actions, judgment, and leadership” by putting them on SBF.

די פירמע האט געזאגט:

"די טעזיס פֿאַר אונדזער ינוועסמאַנט אין FTX איז געווען צו ינוועסטירן אין אַ לידינג דיגיטאַל אַסעט וועקסל פּראַוויידינג אונדז פּראָטאָקאָל אַגנאָסטיק און מאַרק נייטראַל ויסשטעלן צו קריפּטאָ מארקפלעצער מיט אַ אָפּצאָל האַכנאָסע מאָדעל און קיין טריידינג אָדער וואָג בלאַט ריזיקירן."

נייַעס פון אַרום די קריפּטאָווערסע

פאָרשונג הויכפּונקט

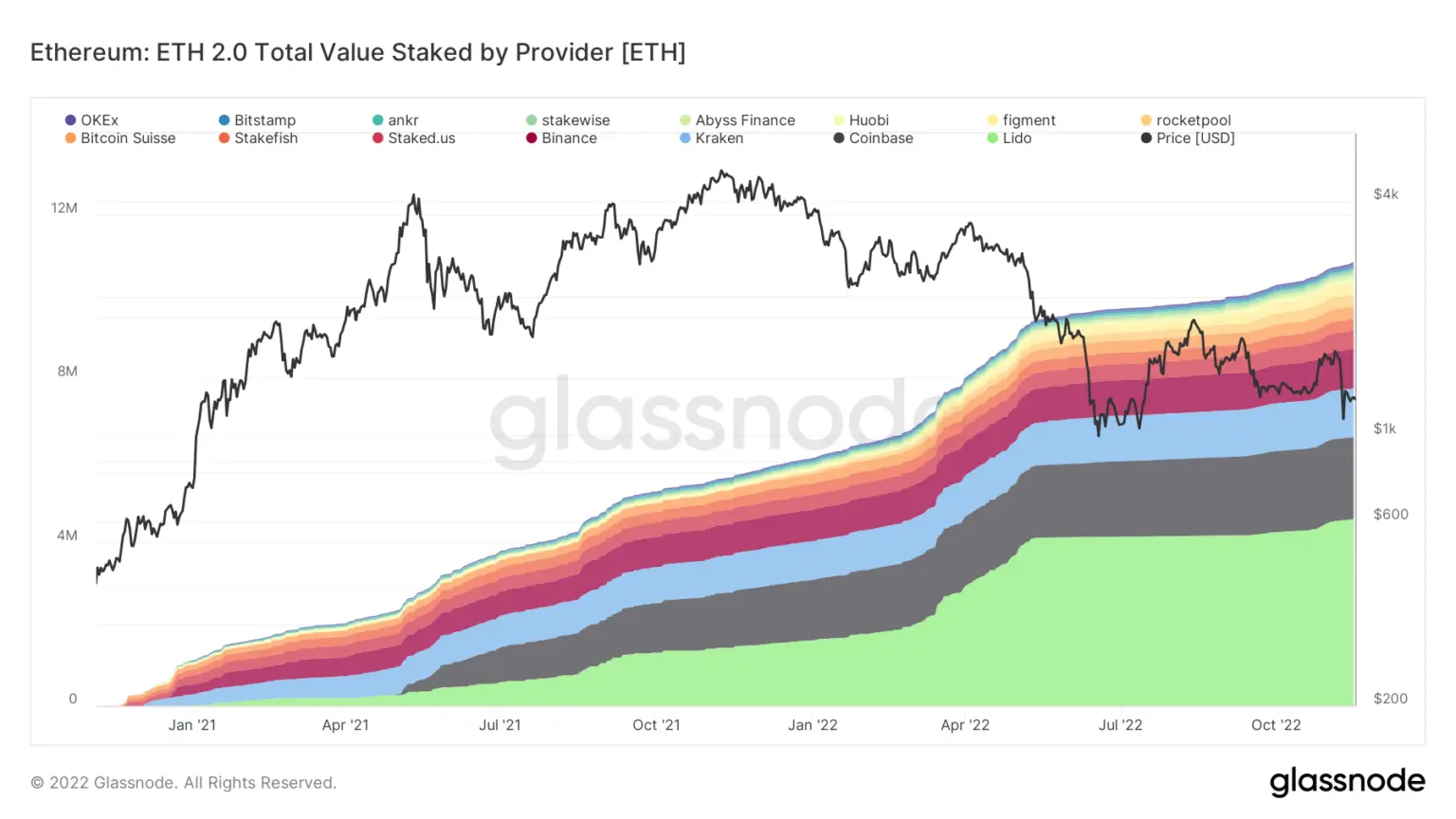

פאָרשונג: 78% פון אַלע סטאַקט ETH איז צווישן 4 סענטראַלייזד פּראַוויידערז; 74% פון אַלע בלאַקס זענען OFAC געהאָרכיק

CryptoSlate analysts examined Ethereum staking on-chain data and revealed that around 78% of all staked Ethereum is dispersed across four centralized providers.

There are 8-9 million Ethereum currently staked across לידאָ (קסנומקס מיליאָן), קאָינבאַסע (קסנומקס מיליאָן), קראַקען (1,2 מיליאָן), און Binance (קסנומקס מיליאָן).

Almost 75% of all Ethereum blocks are considered to be OFAC compliant. 15% of all blocks produced by Ethereum are still non-OFAC compliant, and the other 11% are non-MEV-Boost blocks.

קריפּטאָ מאַרקעט

אין די לעצטע 24 שעה, ביטקאָין (בטק) געוואקסן מיט 0.58% צו האַנדלען ביי $ 16,678, בשעת עטהערום (ETH) דיקליינד מיט 0.73% צו האַנדלען ביי $ 1,202.

ביגאַסט געווינער (24 שעה)

ביגאַסט לוזערז (24 שעה)

Source: https://cryptoslate.com/cryptoslate-wrapped-daily-oldest-bitcoin-holders-start-selling-ftx-court-filing-reveals-sbfs-1b-loans-from-alameda/