פאַרבינדן אונדזער טעלעגראַם קאַנאַל צו בלייבן דערהייַנטיקט אויף ברייקינג נייַעס קאַווערידזש

The Uniswap price found a launchpad from the $5.0 psychological level staging a 10% rally to close the day above $5.4 midweek. The token of the leading decentralized exchange (DEX) was hovering at $5.48 during Thursday’s early Assian trading session. It has printed a doji candlestick on the 12-hour chart signaling a fierce battle between buyers and sellers.

Uniswap’s Updated Privacy Policy Sees Backlash

Popular Ethereum-based DEX Uniswap recently revealed that it had updated its privacy policy admitting collection of user data. This has irked some members of the crypto community, raising concerns whether the platform’s collection and storage of user data works against the core value of the crypto industry which are centered around privacy and decentralization.

In a press statement released in a blog פּאָסטן earlier this week the platform admitted to collecting data that “includes public on-chain data and limited off-chain data like device type, browser version, etc.” Uniswap Labs also added that it did not collect users’ personal data including their names, street addresses, email addresses, date of birth, or IP addresses.

In response to Uniswap’s updated policy, some outspoken members of the Uniswap community argue that by collecting and storing user information the entity violated the tenets of decentralization which are focused on user privacy and anonymity.

On of the strongest criticisms of Uniswap’s new policy came from the team behind Firo, a privacy centric cryptocurrency and ecosystem, who shared their concerns with their over 83,700 followers in a November 21 Twitter post followers arguing that the DEX has set a “dangerous precedent” for decentralized trading platforms.

בשעת מיר האָבן די מאַקסימאַל רעספּעקט אין וואָס @יוניסוואַפּ האט געבויט, מיר שטארק אָפּוואַרפן די ינקאָרפּעריישאַן פון דאַטן זאַמלונג צו שפּור באַניצער נאַטור און אָנטשאַין טעטיקייט. דאָס שטעלט אַ געפערלעך פּרעסידענט פֿאַר DEXes. https://t.co/h4kCiQKtl7

- פיראָ $פיראָ (@firoorg) נאוועמבער קסנומקס, קסנומקס

OwenP, an outreach official at Spookyswa, added his voice to the debate ווערטל that he was disappointed that Uniswap took such a move. His post on twitter read:

“We were contacted [at] SpookySwap by an infrastructure provider once who asked about our backend and what info we kept and we were shocked by the question. “None of course” the answer..”

Transparency continues to be a thorny issue for the crypto space and concerns have heightened following the collapse of the digital asset exchange giant FTX.

As such, the effects of FTX’s collapse continue to rock the market with crypto prices struggling to initiate any strong recoveries.

Crypto traders have remained cautious following the FTX קריזיס that started in the first week of November. According to recent bankruptcy filings, the once $32 billion crypto empire has less than $1.25 billion cash reserves. To make matters worse, the FTX Group has $3.1 billion in liabilities and slightly over 1 million creditors.

Uniswap Price Prediction: Levels To Watch For UNI In Current Bear Market Conditions

UNI price has been “trading” on shaky grounds after its new privacy policy raised security concerns amongst Uniswap investors. Earlier in November, at the height of the FTX debacle, the token posted tremendous gains taking a completely opposite direction from the entire crypto market, as investor confidence in centralized exchanges (CEXs) dwindled, shifting interest into DEXs.

At the time, UNI rallied 37% between November 9 and 15 to brush shoulders with $6.5. The Uniswap price has since corrected to the current price around $5.48.

If the price turns up from the current levels, the ensuing demand pressure may fuel UNI’s recovery. The 12-hour chart brings to light a buy signal presented by the Moving Average Convergence Divergence (MACD) indicator. This is reflected by the 12-period Exponential Moving Average (EMA), represented by the blue line, crossing above the 26-period EMA (orange line), implying that sellers are exhausted and it’s time for buyers to take control.

UNI / USD טעגלעך טשאַרט

If Uniswap bulls win the ongoing battle and subsequently close the 12-hour session in green, the Moving Average Convergence Divergence (MACD) indicator will move to cross the zero line into the positive region to cement the bulls’ return to the market.

However, traders must wait for the MACD to cross the midline before triggering larger buy orders. Movement of the Uniswap price above the 23.6% retracement level at $5.8 will be another cue for a sustainable recovery.

Beyond that, UNI bulls would be bolstered to push the altcoin upward to tag the 61.8% Fibonacci level north of the $7.5 psychological level.Traders can start booking profits at the 38.2% Fibonacci level, as highlighted around $6.5 above the moving averages sitting between $6.22 and $6.34.

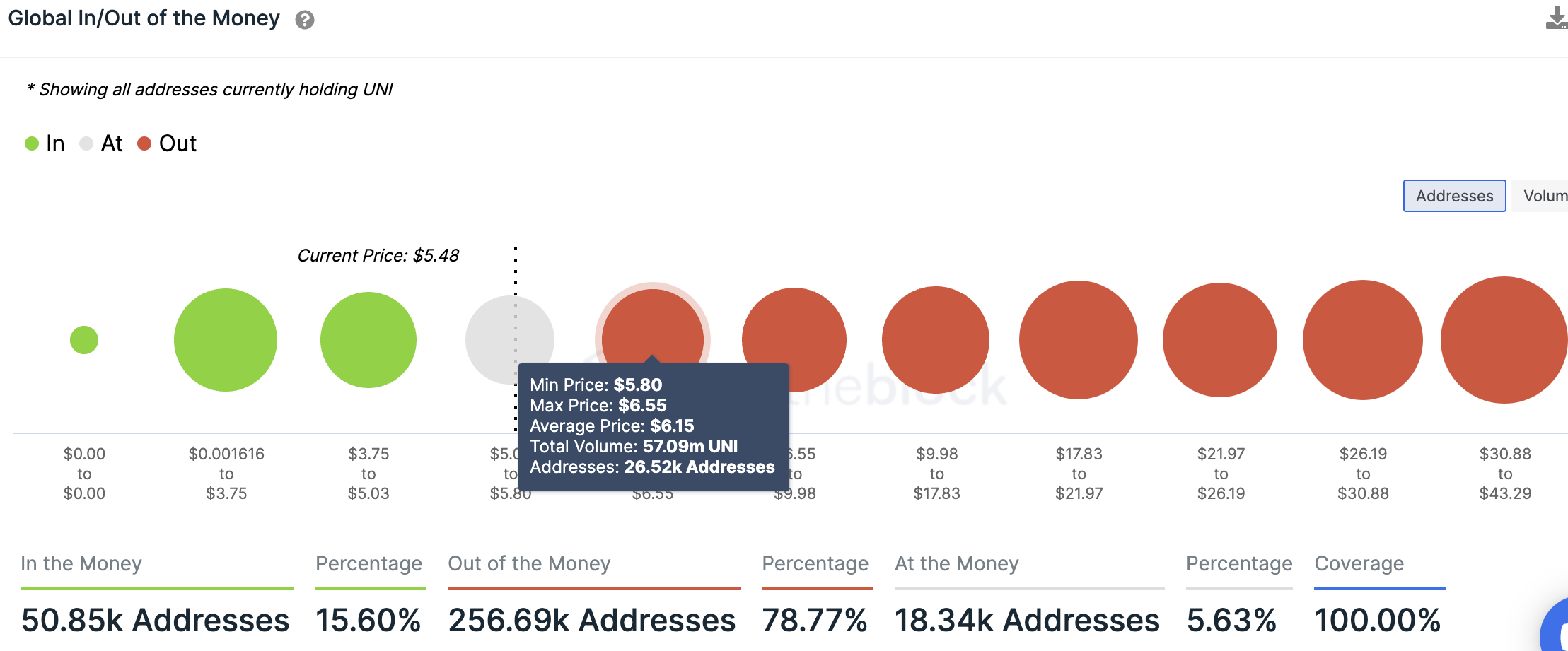

The presence of many suppliers within the aforementioned zone where the 50, 100 and 200 SMA lie may put brakes on the move to $7 and eventually to $10. Insights from IntoTheBlock’s Global In/Out of the Money (GIOM) model reveals that 26,520 addresses previously bought 57.08 million UNI in that range. As the crypto recovers, some investors could close their positions at their respective breakeven points, resulting in increased overhead pressure.

יוניסוואַפּ GIOM טשאַרט

On the downside, if Uniswap price favors the sellers, they will pull the price lower first toward the $5.0 psychological level and later to the $4.75 swing low. A lower decline could trigger massive sell orders that would see the crypto record lower levels with $4.5 providing the first line of defense.

This bearish outlook is highly likely given the current market conditions. The FTX contagion continues and there is not telling how far the effects will reach. The macro climate continues to increase the headwinds leaving crypto investors with less portable projects to pump their capital into.

As such, there are some interesting pre sales that are currently going in the crypto space with a potential to increase investors’ returns once they are listed on exchanges. An example with such a crypto with an optimistic outlook is the IMPT טאָקען, whose presale is ongoing. The token has so far garnered $13.5 million in the presale. As a bonus, the Impact Token team is running a גיוואַוויי פּראָמאָ פון 100K. ייַלן זיך און נעמען אָנטייל אין דעם גיוואַוויי אַזוי אַז איר טאָן ניט פאַרפירן אַ יקסייטינג געלעגנהייט.

סימילאַרלי, לאָך 2 האַנדל קומט אויך אריין צווישן די צוגעזאגטע צייכנס. דער פּלאַטפאָרמע ינייבאַלז די שאַפונג און טעסטינג פון טריידינג סטראַטעגיעס פֿאַר טריידערז און ינוועסטערז צו מאַכן ינפאָרמד מאַרק דיסיזשאַנז. דאַש 2 האַנדל איז דיזיינד צו נעמען דיין קריפּטאָ טריידינג צו דער ווייַטער מדרגה דורך צושטעלן דאַטן-באזירט קריפּטאָ סיגנאַלז.

מיט אַ טריידינג סייכל פּלאַטפאָרמע ווי דאַש, לומינג דיזאַסטערז ווי די ייַנבראָך פון FTX קענען זיין ספּאַטאַד איידער זיי פאַלן און העלפֿן טריידערז און ינוועסטערז צו באַוואָרענען זייער אַסעץ און מאַכן מאַרק-ביטינג קערט. רעכט איצט, די D2T פּריסייל איז אויף און עס האט אויפשטיין נאָענט צו $ 7 מיליאָן.

פֿאַרבונדענע נייַעס:

דאַש 2 האַנדל - הויך פּאָטענציעל פּרעסאַלע

- אַקטיוו פּרעסאַלע לעבן איצט - dash2trade.com

- געבוירן טאָקען פון קריפּטאָ סיגנאַלז יקאָוסיסטאַם

- KYC וועראַפייד און אַודיטעד

פאַרבינדן אונדזער טעלעגראַם קאַנאַל צו בלייבן דערהייַנטיקט אויף ברייקינג נייַעס קאַווערידזש

Source: https://insidebitcoins.com/news/uniswap-price-prediction-november-24-can-uni-return-to-10